montana sales tax rate on cars

As of 2020 New York has a car tax rate of 4 percent plus local taxes whereas next-door neighbor Massachusetts has a state car tax rate of 625 percent with some local rates much higher. For a car purchase with no trade-in your equation would look like this for a.

Vehicle Buying Do You Pay Sales Tax For The State You Buy From Or Live In

The Montana sales tax rate is currently.

. Fees collected at the time of permanent registration are. Were available Monday through Thursday 900 am. With more than 19 years of experience in this field we are ready to answer any questions.

We can form a Montana LLC for you including the LLC formation and initial plate registration all for a total of 849. The good news is the Empire State limits its vehicle sales tax to a maximum of 725. Montana charges no sales tax on purchases made in the state.

Car tax as listed. States like Montana New Hampshire Oregon and Delaware do not have any car sales tax. Ad Lookup MT Sales Tax Rates By Zip.

The County sales tax rate is. There are no local taxes beyond the state rate. 635 for vehicle 50k or less.

Montana has no state sales tax and allows local governments to collect a. This is the total of state county and city sales tax rates. Free Unlimited Searches Try Now.

Six of Montanas 56 counties do not collect a local option vehicle tax. Did South Dakota v. 2 A local option motor vehicle tax or flat fee is.

10 Montana Highway Patrol Salary and Retention Fee. Wayfair Inc affect Montana. While states like North Carolina and Hawaii have lower sales tax rates below 5.

This is the total of state county and city sales tax rates. Local option motor vehicle tax. Only a few counties enforce a local state tax which is why Montanas average combined sales tax rate is only 0002.

The Kalispell sales tax rate is. The state sales tax rate in Montana is 0 but you can customize this table as needed to reflect your applicable local sales tax rate. When it comes to taxes and fees Montana is a mixed bag.

Gallatin County collects a 05 percent local option vehicle. The cities and counties in Montana also do not charge sales tax on general purchases so. 425 Motor Vehicle Document Fee.

Over 94 of Americans qualify for lower. If you need help working with the department or figuring out our audit appeals or relief processes the Taxpayer Advocate can help. Knowing how much sales tax to pay when purchasing a vehicle also helps you to know when asking for financing from a lender.

County tax 9 optional state parks support certain special plate fees and for light trucks the gross vehicle weight GVW fees. 775 for vehicle over 50000. Tourism-related firms such as hotels and campers 7 and rental car companies 7 are subject to additional taxes 4 percent.

States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Montana local counties cities and special taxation districts. Big Horn Deer Lodge Flathead Granite Phillips and Richland.

For example in New York the state sales tax rate is 4 but county and local taxes can boost the rate up to 45 more. We are known for sound trustworthy advice and smart representation. 1 A county may impose a local option motor vehicle tax on motor vehicles subject to the registration fee imposed under 61-3-321 2 or 61-3-562 at a rate of up to 07 of the value determined under 61-3-503 or a local flat fee in addition to the fee imposed under 61-3-321 2 or 61-3-562.

Learn more about MT vehicle tax obtaining a bill of sale transferring vehicle ownership and more. Vehicle owners to register their cars in Montana. Montana is one of only four states that do not have a.

While Montana does not have a sales tax certain products such as alcohol. Tax Free Montana Vehicle Registration Services. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate.

The minimum combined 2022 sales tax rate for Rexford Montana is. Get free quotes from the nations biggest auto insurance providers. While there is no statewide sales tax in Montana several municipalities and localities particularly large tourist sites levy local sales taxes on most goods.

The County sales tax rate is. In other words you might pay a tax rate between 4 and 85 for the same car at the same sales price. The minimum combined 2022 sales tax rate for Kalispell Montana is.

Add these three tax rates together to find the total sales tax. The Montana sales tax rate is currently. Heggen Law Office PCs Montana RV and vehicle registration services are designed for you to avoid sales tax and high licensing fees.

The state sales tax rate in Montana is 0000. The Rexford sales tax rate is. Join 1972984 Americans who searched for Car Insurance Rates.

Because there is no sales tax in the state and several counties also do not levy a local option tax the cost of registering luxury vehicles here as opposed to other states that may have registration fees sales tax and local taxes is significantly lower. And Friday 900 am. Montana cars and trucks are exempt from sales tax in Montana MCA 61-3-311 and if you own your pickup van or car through a Montana LLC you can take advantage of permanent registration.

What states have the highest sales tax on new cars. Montana has no statewide sales tax for vehicle purchases. Montana MPG 1497 Miles 14556 Average pricegallon 225 Annual Cost 2189.

New Jersey Sales Tax Small Business Guide Truic

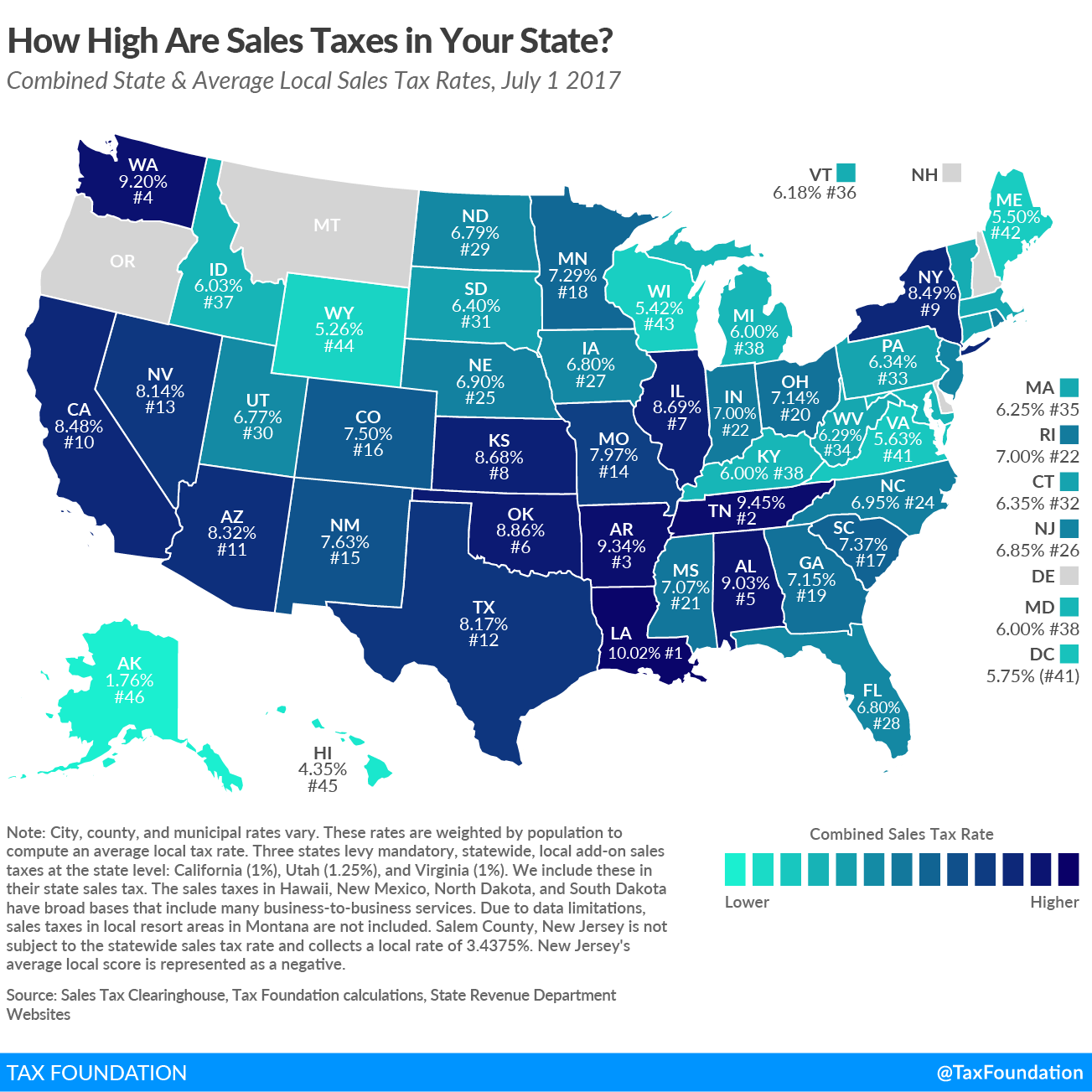

States With Highest And Lowest Sales Tax Rates

States With No Sales Tax On Cars

How Is Tax Liability Calculated Common Tax Questions Answered

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

What S The Car Sales Tax In Each State Find The Best Car Price

Sales Taxes In The United States Wikiwand

What S The Car Sales Tax In Each State Find The Best Car Price

Sales Taxes In The United States Wikiwand

Map How Much Is Sales Tax In Each State

What S The Car Sales Tax In Each State Find The Best Car Price

Louisiana Sales Tax Rate Remains Highest In The U S Legislature Theadvocate Com

Is Buying A Car Tax Deductible Lendingtree

A Complete Guide On Car Sales Tax By State Shift

Most Americans Live In States With Variable Rate Gas Taxes Itep